KZA Articles

Explore our featured articles to gain deeper understanding and insights into your specific field of interest or expertise.

Looking for something specific? Utilize our search feature by typing in a key word!

Recognizing Burnout in Healthcare Staff and Ideas for Addressing It

Read the contributing factors to healthcare worker burnout and the results of a survey that assesses the factors of employment that healthcare workers most value. Using the results, we’ll present four best practices for reducing burnout and retaining employees.

By Synchrony, Health & Wellness

Read the contributing factors to healthcare worker burnout and the results of a survey that assesses the factors of employment that healthcare workers most value. Using the results, we’ll present four best practices for reducing burnout and retaining employees.

5 Ways to Help Improve Revenue Cycle Management

Revenue cycle management (RCM) is critical for health and wellness providers. Implementing RCM best practices could help you improve your patient experience and stay financially healthy.

By Maureen Bonatch M.S.N., R.N. and Suchi Rudra

Registered Nurse and Digital Writer

Revenue cycle management (RCM) is critical for health and wellness providers. Implementing RCM best practices could help you improve your patient experience and stay financially healthy. Read more.

The Rise of Automated Downcoding – White Paper

Physician practices are experiencing a sharp increase in systematic downcoding by major commercial payors. This trend, driven largely by AI-powered algorithms, is resulting in significant revenue loss, higher administrative burden, and frustration for practices.

The Rise of Automated Downcoding: Trends, Causes, and Strategies for Physician Practices

By Cathy McDowell, MBA, BSN

President and CEO

Karen Zupko & Associates, Inc.

August 2025

Executive Summary

Physician practices are experiencing a sharp increase in systematic downcoding by major commercial payors (1)(6). This trend, driven largely by AI-powered algorithms, is resulting in significant revenue loss, higher administrative burden, and frustration for practices.

Background

Beginning in late 2022, payors began using AI and machine learning to evaluate claims, replacing the largely manual, audit-driven downcoding process. By 2025, this technology had transformed downcoding into a routine, automated cost-control strategy, predicting justified service levels from structured claim data.

Current Trends (2025)

1. Targeted Services: Evaluation & Management (E/M) visits are the most common adjustments, along with telehealth services and split/shared visits (3)(4).

2. Payors Leading the Trend: UnitedHealthcare (3), Cigna (4), Aetna (5), Regional Blue Cross/Blue Shield, Humana (6).

Why Is This Happening?

Cost Containment (6), Post-2021 CPT Guideline Shifts (1), Peer Comparison Algorithms (4), Documentation Gaps (2).

Impact on Practices

Revenue erosion can result in six-figure annual losses for practices. The administrative burden of appealing each claim delays payment and increases costs, while physicians report growing frustration as AI-driven decisions occur without full record review (6).

Strategies for Practices

Recommended strategies include monitoring CPT submissions against paid codes by payer, validating documentation internally, appealing denials with strong evidence, and strengthening documentation templates and workflows (6)(1)(2).

Advocacy and Industry Response

The AMA and MGMA are advocating for transparency in AI-driven downcoding algorithms (1)(6). Specialty societies such as AAOS and ACS are preparing position statements. Regulatory agencies, including CMS, have required that Medicare Advantage plans provide justification for automated downcoding and ensure a fair appeals process (2).

The Path Forward

Practices must collect evidence of inappropriate systemic downcoding, appeal every automated downcode to create a documented pattern (6), and engage with professional societies to push for transparency and oversight.

Conclusion

Automated downcoding represents a significant shift in payer behavior. By tracking trends, enhancing documentation, consistently appealing, and participating in advocacy efforts, physician practices can mitigate financial damage while advocating for systemic reform (6)(2).

KZA stands ready to partner with practices to provide support through downcoding impact dashboards, audit documentation for appeals, internal documentation education, and templates with guidance for the appeal process.

References

1. American Medical Association. (2021). CPT® Evaluation and Management Guidelines.

2. Centers for Medicare & Medicaid Services. (2021). MLN Matters SE21002: Evaluation and Management Services.

3. UnitedHealthcare. (2024). Professional E/M Coding Policy.

4. Cigna. (2024). E/M Review Guidelines.

5. Aetna. (2024). Clinical Policy Bulletins.

6. Medical Group Management Association. (2025). Advocacy Updates on Downcoding and AI Algorithms.

Webinar: Tools for Financial Discussions with Orthopedic Patients

This webinar will dive into ways healthcare leaders can leverage digital solutions to create more opportunities for providers to engage with patients on topics that directly impact their experience such as financial discussions that may help increase patient satisfaction, loyalty and retention.

By Synchrony, Health & Wellness

This webinar will dive into ways healthcare leaders can leverage digital solutions to create more opportunities for providers to engage with patients on topics that directly impact their experience such as financial discussions that may help increase patient satisfaction, loyalty and retention.

Tools and Resources to Help Your Team Succeed

Get the support you need to simplify the financing conversation for your staff and your patients or clients. CareCredit offers in-office and online marketing materials, scripts, tools for calculating estimated payments and much more.

By Ilima Loomis

Digital Writer

Get the support you need to simplify the financing conversation for your staff and your patients or clients. CareCredit offers in-office and online marketing materials, scripts, tools for calculating estimated payments and much more.

The Details of Denials Matter

It is interesting how orthopaedic surgeons react when they see a denial report for the first time. They often react first with surprise, followed by a perplexed question: “Why didn’t anyone inform me about this earlier?”

AAOSNow – Winter 2023

by Karen Zupko

It is interesting how orthopaedic surgeons react when they see a denial report for the first time. They often react first with surprise, followed by a perplexed question: “Why didn’t anyone inform me about this earlier?”

Simple Patient Financing Solutions for Maximizing Treatments

Many aesthetic practices and spas we work with offer patient financing—but you’d never know it. Either there’s nothing mentioned on the Web site or it’s like an Easter egg hunt to find the information. When scheduling, patients raising concerns or questions about fees—are rarely told that financing is offered. Many practices wait and discuss financing only after a patient is seen and wants to schedule. It’s big mistake.

Aesthetic Society News – Fall 2022

by Karen Zupko

Many aesthetic practices and spas we work with offer patient financing—but you’d never know it. Either there’s nothing mentioned on the Web site or it’s like an Easter egg hunt to find the information. When scheduling, patients raising concerns or questions about fees—are rarely told that financing is offered. Many practices wait and discuss financing only after a patient is seen and wants to schedule. It’s big mistake.

CMS Updates Physician Assistant and Nurse Practitioner Billing

In January, CMS introduced guideline changes to its Medicare reporting rules that impact PA/NP billing. These changes could require practices to modify how they report split/shared services. Previously, shared services were frequently reported in the name of a physician. Now, new rules determine who can report the services. Failing to comply with the new CMS rules will create compliance risks for physician practices.

AAOSNow – May 2022

by Sarah Wiskerchen

In January, CMS introduced guideline changes to its Medicare reporting rules that impact PA/NP billing. These changes could require practices to modify how they report split/shared services. Previously, shared services were frequently reported in the name of a physician. Now, new rules determine who can report the services. Failing to comply with the new CMS rules will create compliance risks for physician practices.

Disclaimer: Full article requires AAOSNow login.

Commonly Asked Coding Questions in 2022

In this column, KZA addresses recently asked questions on coding for various orthopaedic procedures posed by orthopaedic surgeons, practice managers, and staff.

AAOSNow – March 2022

by Sarah Wiskerchen

In this column, KarenZupko & Associates addresses recently asked questions on coding for various orthopaedic procedures posed by orthopaedic surgeons, practice managers, and staff.

Disclaimer: Full article requires AAOSNow login.

Op Note Documentation Tips Every Surgeon Can Use

You’ve submitted, in a timely manner, correct Current Procedural Terminology® (CPT) codes to the insurance company for the procedure you performed. The payor’s explanation of benefits (EOB) or electronic remittance advice (ERA) shows a payment of $0! Now what? Typically, you’d send in the operative note, showing the description of the procedure you performed.

You’ve submitted, in a timely manner, correct Current Procedural Terminology® (CPT) codes to the insurance company for the procedure you performed. The payor’s explanation of benefits (EOB) or electronic remittance advice (ERA) shows a payment of $0! Now what? Typically, you’d send in the operative note, showing the description of the procedure you performed.

The operative note is not only a medico-legal and patient care document. It’s usually the only information a payor wants when there is a dispute about your reimbursement.

So let’s walk through some key elements of the operative report documentation.

Pre-operative and Post-operative Diagnoses

All relevant pre- and post-operative diagnoses should be documented, including underlying co-morbid conditions that you consider relevant for the procedure performed. If a pre-op diagnosis is no longer relevant, or changes intra-operatively, then state this in the post-operative diagnosis statement.

For example, if the tumor or lesion pathology is not known pre-operatively, it is acceptable to state “unknown” in the pre-op diagnosis. If the frozen section comes back positive for a malignancy, this could be stated in the post-op diagnosis area.

Surgeon

The primary surgeon for the procedure is listed as the surgeon. In the academic environment, this is the attending surgeon for the procedure.

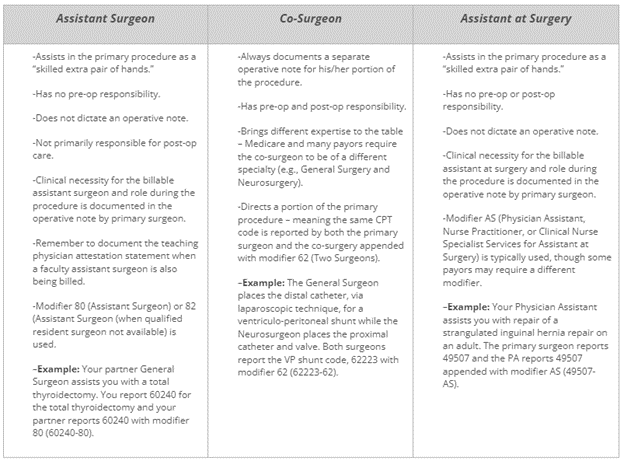

Assistant Surgeon vs. Co-Surgeon vs. Assistant at Surgery

Not crystal clear on the difference? Here are some tips that describe the different surgical roles typically seen in a procedure.

Procedure(s) Performed

The procedures performed are listed in this area of the operative note, which is typically on the top half of the first page. We recommend using CPT terminology as much as possible, but not including codes in the operative note. Why? Oftentimes, the codes documented in the operative note are not accurate.

It becomes a compliance issue when the codes in the operative report do not match the codes billed on the CMS 1500 claim form. Medicare’s General Principles of Medical Record Documentation state the CPT and ICD-10-CM codes reported on the health insurance claim form or billing statement should be supported by the documentation in the medical record. When a CPT code is documented in the operative report but not billed the CPT code billed is not “supported by the documentation in the medical record” as Medicare requires.

Indications for Surgery

This short paragraph, a couple of sentences, is very important as it provides the clinical necessity for the procedure being performed. It is also important to state any previous, related surgery on the same or different structure/wound, why patient is being brought back to the OR, or planned future surgery, as these are clues that coders use to support specific modifiers.

For example, a patient may require stages, of surgery to reconstruct an open wound which would warrant use of modifier 58 (Staged or Related Procedure or Service by the Same Physician or Other Qualified Health Care Professional During the Postoperative Period). Stating clearly that the staged procedures are prospectively planned, in this case, would tell the coder and payor that modifier 58 is warranted and the full allowable should be paid. All too often, when the planned nature of multiple procedures is not documented, a modifier 78 (Unplanned Return to the Operating/Procedure Room by the Same Physician or Other Qualified Health Care Professional Following Initial Procedure for a Related Procedure During the Postoperative Period) is used, which generally results in a payment reduction.

Complexity

This separate paragraph is a must if modifier 22 (Increased Procedural Services) will be used to obtain additional payment. This information should summarize the added complexity that will be in the subsequent details documented in the operative note. Don’t expect a payor to wade through the details of the operative note to try to figure out whether to pay you more. Make it easy for the payor to “feel your pain” of the procedure in a Complexity, or Findings at Surgery, paragraph.

Details or Description of Procedure

This is typically the lengthiest area of the operative note that describes the procedure(s) performed in great detail. Documentation should include, but not be limited to, induction of anesthesia, patient positioning, set-up and use of special equipment (e.g., stereotactic navigation, robot), specific brand name of any implant(s), which surgeon did what when more than one surgeon is involved, etc.

The details in this section of the operative note should support the procedures listed in the aforementioned Procedure(s) Performed area, which should also support the CPT code(s) reported for the procedure(s).

6 Essential Coding Rules Everyone Needs to Know

Current Procedural Terminology® (CPT) is a coding system that physicians and other providers use to bill for their services. While typically not taught in medical school, residency or other formal education arenas, providers are still expected to know how to properly code for services provided.

Current Procedural Terminology® (CPT) is a coding system that physicians and other providers use to bill for their services. While typically not taught in medical school, residency or other formal education arenas, providers are still expected to know how to properly code for services provided.

Here are six basic coding rules that apply to all specialties and that every provider, manager, billing, and coding staff must follow. Understanding the basics will help providers code accurately and reduce the risk of an audit or insurance company takeback or refund.

1. Do not report multiple CPT codes when a single comprehensive code describes these procedures. Doing so is called “unbundling.”

For example, there are codes that describe a tonsillectomy and adenoidectomy performed at the same operative session (42820-42821). It is considered “unbundling” if two separate codes are reported – one for the tonsillectomy (42825-42826) and one for the adenoidectomy (42830-42836).

Another example is use of the exploratory laparotomy code, 49000. An exploratory laparotomy is included in all other laparotomy codes; therefore, 49000 would not be separately reported. To do so is considered “unbundling” because the more comprehensive code includes the exploratory laparotomy.

2. Avoid “upcoding.” Do not report a “higher” code when a “lower” code is more accurate.

“Upcoding” oftentimes occurs when reporting Evaluation and Management (E/M) codes for office and hospital non-surgical services. If the documentation supports 99203 (new patient visit, level 3), it is considered “upcoding” if the provider codes the service as a higher level such as 99204 (new patient visit, level 4).

3. Remember that there are services integral to a CPT code. Refer to CPT guidelines and your physician specialty publications for more information.

CPT guidelines are not very specific about the services integral to a surgical procedure code. From an intraoperative standpoint, CPT states only the “local infiltration, metacarpal/metatarsal/digital block or topical anesthesia” is included. The assumption is that services normally performed as part of a single CPT code would not be separately coded.

The lack of specificity in CPT has led several physician specialty societies to publish their own guidelines for members and coders.

A good example is performing a lumbar discectomy with use of fluoroscopy for disc space localization. The American Academy of Orthopaedic Surgeons’ Code-X, as well as the American Association of Neurological Surgeons Guide to Coding, state that fluoroscopy is included in all open surgical procedure codes and not separately reported as shown in the table below.

| Correct | Incorrect |

|---|---|

63030 Lumbar discectomy |

63030 Lumbar discectomy |

76000 Fluoroscopy |

4. Access or exposure (e.g., approach), is included in all surgical CPT codes with one exception.

CPT codes describe complete procedures. The incision/exposure/approach to the level of the pathology is included in all surgical procedure codes and should not be separately coded. The American Academy of Orthopaedic Surgeons’ Code-X and the American Association of Neurological Surgeon’s Guide to Coding are examples of how physician specialty societies have specifically defined that the access or approach to the procedure is included in the CPT code.

For example, the endoscopic intranasal approach to a pituitary tumor is included in 62165 (endoscopic transnasal excision of a pituitary tumor). When the otolaryngologist performs the endoscopic intranasal approach for the neurosurgeon to excise the pituitary tumor, then each surgeon reports the same CPT code with modifier 62 (Two Surgeons). The exposure/approach is included in 62165, a stand-alone CPT code, and should not be separately reported with component codes as shown in the table below.

| Correct | Incorrect |

|---|---|

62165-62 |

Neurosurgery: |

Endoscopic pituitary tumor removal (co-surgery modifier) |

62165 Endoscopic pituitary tumor removal billed by neurosurgery |

ENT: |

|

30520 Septoplasty |

|

31287 Sphenoidotomy |

Another example is in spine surgery. The approach, or access, to the spine is included in all open spine surgical CPT codes. For example, the retroperitoneal approach is included in 22558 (anterior lumbar interbody fusion) because the procedure could not be accomplished without it. Therefore, when the vascular or general surgeon performs the approach – which is included in 22558 – the code is appended with modifier 62 and reported by both the approach and spine surgeons. It is not accurate for the approach surgeon to report a code such as an exploratory laparotomy (49000).

One exception: the skull base surgery codes (61580-61616) are separated into approach (61580-61598) and definitive procedure (61600-61616) for the resection and closure.

5. The usual closure is included in all surgical procedure CPT codes.

What is the “usual” closure? Well, that depends on the surgical procedure code. All surgical codes include the direct, or primary, closure where the wound edges of the operative tract created by the surgeon are closed primarily at the same operative session.

In general, my simple rule applies: if you open it, you’re supposed to close it.

Some codes may have language that closure is not included. In those instances, closure is typically not performed because the operative wound size is small such as in 41110 (excision of lesion of tongue without closure).

The excision of benign (114xx) and malignant (116xx) skin lesion codes includes a simple, or single layer, closure. If the closure qualifies for an intermediate (12031-12057) or complex (13100-13153) closure, it may be separately reported with the skin lesion excision code.

6. A “scout” endoscopy, diagnostic service, or exploratory procedure is included in a definitive CPT code performed at the same operative session.

Another of my simple rules is, if you are coding for cutting it out, you would not code for diagnosing or finding it.

For example, if you are doing a laryngectomy (31360), then the scout laryngoscopy to assess extent of disease and landmarks (31525) performed at the same operative session is included in the laryngectomy code and not separately reported.

Will the Real Conversion Rate Please Stand Up?

Everyone agrees that it’s important to understand how many patients seen in consultation actually schedule surgery. Aesthetic surgeons measure their value on it, and patient care coordinators are rewarded for improving it. Nearly every aesthetic surgeon we talk with wants to know what is a “good” conversion rate. But if your team calculates a “lump” conversion rate for the year, you’re missing the bigger picture. Not to mention lacking the nuanced data needed for making strategic marketing and performance improvement decisions.

ASN July 2018

by Karen Zupko

Everyone agrees that it’s important to understand how many patients seen in consultation actually schedule surgery. Aesthetic surgeons measure their value on it, and patient care coordinators are rewarded for improving it. Nearly every aesthetic surgeon we talk with wants to know what is a “good” conversion rate.

Arthroscopy Coding for Major Joints - Shoulder

An accurate understanding of coding rules increases likelihood of receiving appropriate payment

Correctly reporting and billing for arthroscopy services is often confusing. Last month, AAOS Now reviewed the knee arthroscopy codes and outlined the appropriate use of modifiers. This month, the topic is coding for shoulder and hip arthroscopic procedures.

AAOSNow – March 2018

by Michael R. Marks, MD, MBA

An accurate understanding of coding rules increases likelihood of receiving appropriate payment

Correctly reporting and billing for arthroscopy services is often confusing.

Last month, AAOS Now reviewed the knee arthroscopy codes and outlined the appropriate use of modifiers. This month, the topic is coding for shoulder and hip arthroscopic procedures.

Arthroscopic shoulder procedures

The traditional coding rule about the shoulder is to consider the joint as one compartment. Due to continuous efforts by orthopaedic societies, a two-compartment (intra- and extra-articular) viewpoint is gaining acceptance. As a result, a few coding rules have changed. Intra-articular structures include the labrum, the long head of the biceps, a Bankart lesion, and the humeral and glenoid articular surfaces. Extra-articular structures include the rotator cuff (RC), the distal clavicle, and the subacromial space.

In 2017, the Centers for Medicare & Medicaid Services (CMS) made a significant change to the extensive débridement code (29823). There are now three situations in which this code can be billed if the extensive débridement portion of the procedure is performed in a separate area of the shoulder joint. This is similar to coding for the knee, which also has distinct anatomic compartments. The applicable codes are:

Disclaimer: Full article requires AAOSNow login.

Dropped Leads. Why They Happened and What to Do About Them

After mystery shopping, over 150 aesthetic plastic surgery practices are available through their websites, arid by phone. We've come up with a pattern for kerplunked leads. Whether the "lead" (AKA "prospective patient") calls or writes your office, you'll be surprised how many inquiries are not answered or answered well.

ASN Winter 2016

by Karen Zupko

After mystery shopping over 150 aesthetic plastic surgery practices through their websites and by phone, we've come up with a pattern of kerplunked leads.

New Physician Onboarding Checklist

Use this checklist to manage the orientation and onboarding activities for each new physician you hire. Ask for regular status updates - especially about the credentialing process. Items listed in each section are not necessarily in chronological order.

by Cheryl Toth, MBA

Use this checklist to manage the orientation and onboarding activities for each new physician you hire. Ask for regular status updates – especially about the credentialing process. Items listed in each section are not necessarily in chronological order.

Build Better Patient Relationships, Faster, Using the FORD Method

It’s a simple question that many patients ask. You can choose to give the patient a simple answer, for example, six weeks, and move on to the next topic on your laundry list of risk factors and scheduling logistics.

ASN Fall 2014

by Karen Zupko

“How long will I have to stop running after surgery?”